A Real Property Reports can become a touchy subject. Realtors opinion varies on the importance of a Real Property Report (RPR) versus Title Insurance. I find it is best to layout the facts for my clients and let them decide on the importance of obtaining this document. This article goes over what I tell my clients about RPRs and when I think it’s best to have this conversation. On my website listquickyeg, I have one article on what an RPR is, and another on how to order an RPR.

Real Property Reports (For Sellers)

I always start the conversation by asking my clients if they remember ordering a surveyors report or receiving an RPR. Unless you purchased your home with Title Insurance, they should have an RPR. If they cannot remember, check your previous purchase contract. Your purchase contract should specify whether you were going to receive an RPR or not. If you were supposed to receive an RPR then the next step is to ask your lawyer. If all else fails, perhaps you did some exterior improvements, like a deck, or addition to their house, which would have required an RPR. If you can find your RPR, not much of an explanation is needed. If you do not have an RPR, here’s what you should know before deciding to order one.

Real Property Report Explained (For Sellers)

I suggest you discuss the RPR with your Realtor prior to listing. The decision you need to make is, whether you will order an RPR or offer potential buyers Title Insurance in lieu. Below is a list of the major points your realtor may bring up:

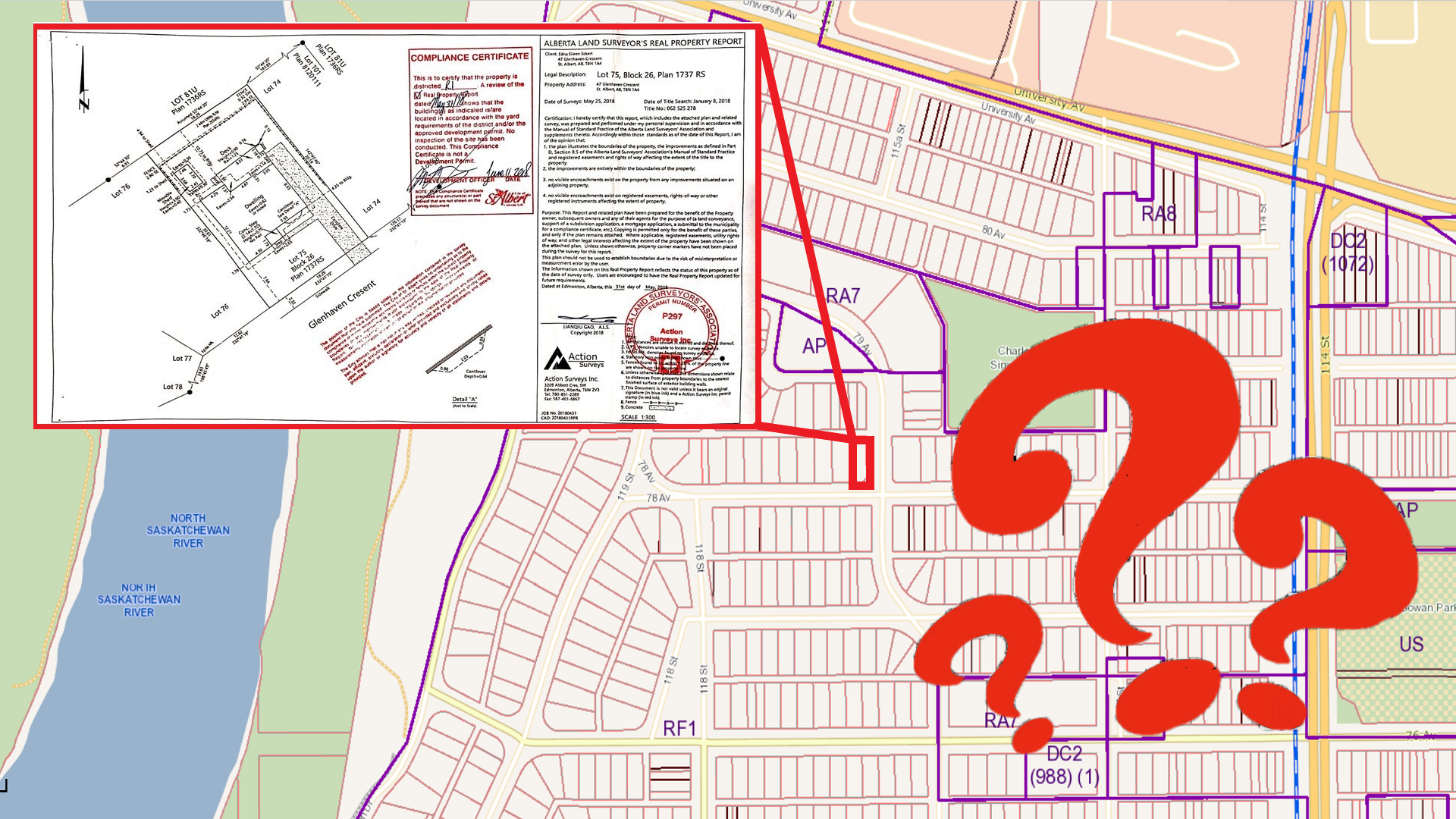

An RPR is a surveyors document, created by a private company, and verified for compliance by the Municipality.

The Purpose of an RPR is to ensure all structural components of your house, garage, fence, and any other upright construction is within the boundary of your land, and compliant with your properties municipal zoning.

For an RPR to be both Current and Compliant, the surveyors report must account for all affixed construction on your land (this makes it current) and compliant with your municipalities zoning (this makes it compliant)

AREA purchase contracts contain a clause in section 10.2 requesting that Sellers provide a Current and Compliant RPR to the Buyer upon closing.

If you do not have a Current and Compliant RPR we can either prepare one or offer your home for sale with Title Insurance in lieu of an RPR.

Title Insurance is a policy you would pay for upon closing rather than the RPR, it’s cheaper and insures the future buyer against any potential encroachment of the Property onto the municipalities land.

Now that you understand what an RPR is, and your options, you can make an appropriate decision. I highly recommend, asking your realtor both the costs and timelines of working with a surveyor and your municipality. This may come in handy for making the right decision.

Real Property Reports Explained (For Buyers)

If you’re buying a property, you should understand what an RPR is before writing an offer. It’s important you know what it means to purchase a house without a current and compliant RPR. The risk varies depending on the age of the house and structures on the land. If my client is buying a home with Title Insurance, I ensure they know these things prior to sending the offer:

Title Insurance only protects you from unknown encroachments between you and the Municipalities land. Any unknown encroachments between you and your neighbours will not be covered under the insurance.

Without a Real Property Report we should inquire further about permits for any home additions, or decks, as we now have no proof, they were completed with the municipalities authorization.

Without a Real Property Report we do not know if your properties fence is on your side of the property line. If it is the neighbours’ fence, it could be demolished without notice, or added to, or not maintained.

Older neighborhoods often have more issues with the house, garage or outbuildings being non-compliant or encroaching onto your neighbour’s property or city land due to changes in zoning.

Buyers are often eager to get the deal done so it is more likely you’l overlook these potential risks. We do not want to scare our clients away from properties, but it is your Realtors job to point out when title insurance is a risk or not. In most cases title insurance is fine, but if you’re dealing with a home that has an addition on it, expensive fence, or large exterior deck, the risk is greater.

To Conclude

Real Property Reports are an easy concept to navigate, if the proper information is conveyed at the proper time. I hope this article helps you, approach the Real Property Report situation in a stress-free way!